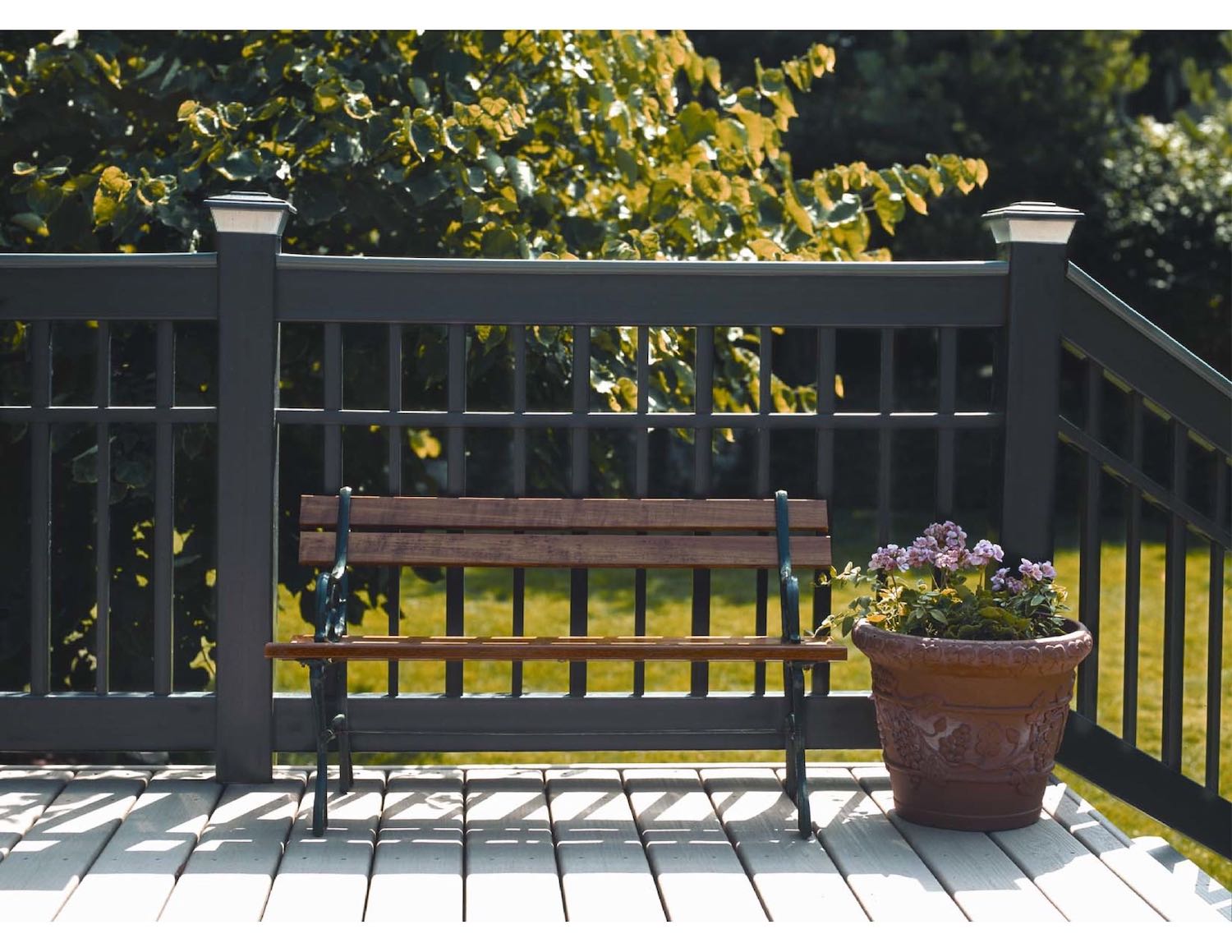

Melunar Solar Deck Lights, 6 Pack Solar Step Lights Outdoor Waterproof LED Solar Fence Lights for Patio, Stairs,Yard, Garden Pathway, Step and Fences, 10 Lumens, Warm White/Color Changing Lighting - - Amazon.com

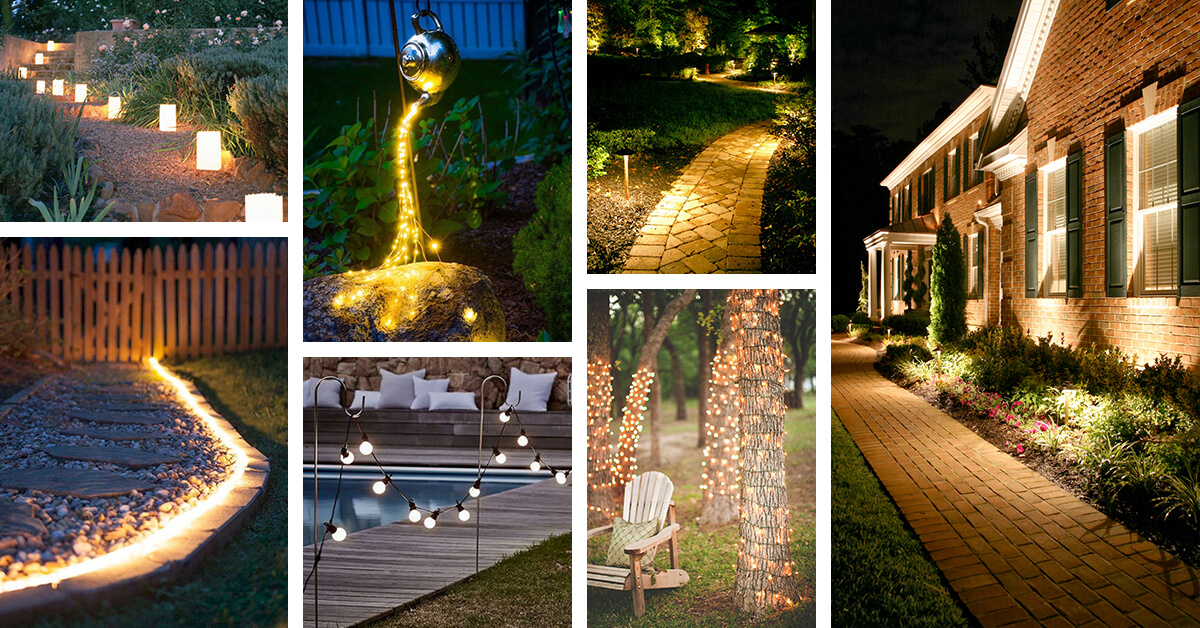

100 Backyard Lighting Ideas | Garden Lighting Ideas | Outdoor Lighting Ideas | Fence Lighting Ideas - YouTube

:strip_icc()/Web_1500-BHG_OVERALLGROUP-8a370f5603544e499dc37dda04059250.jpg)