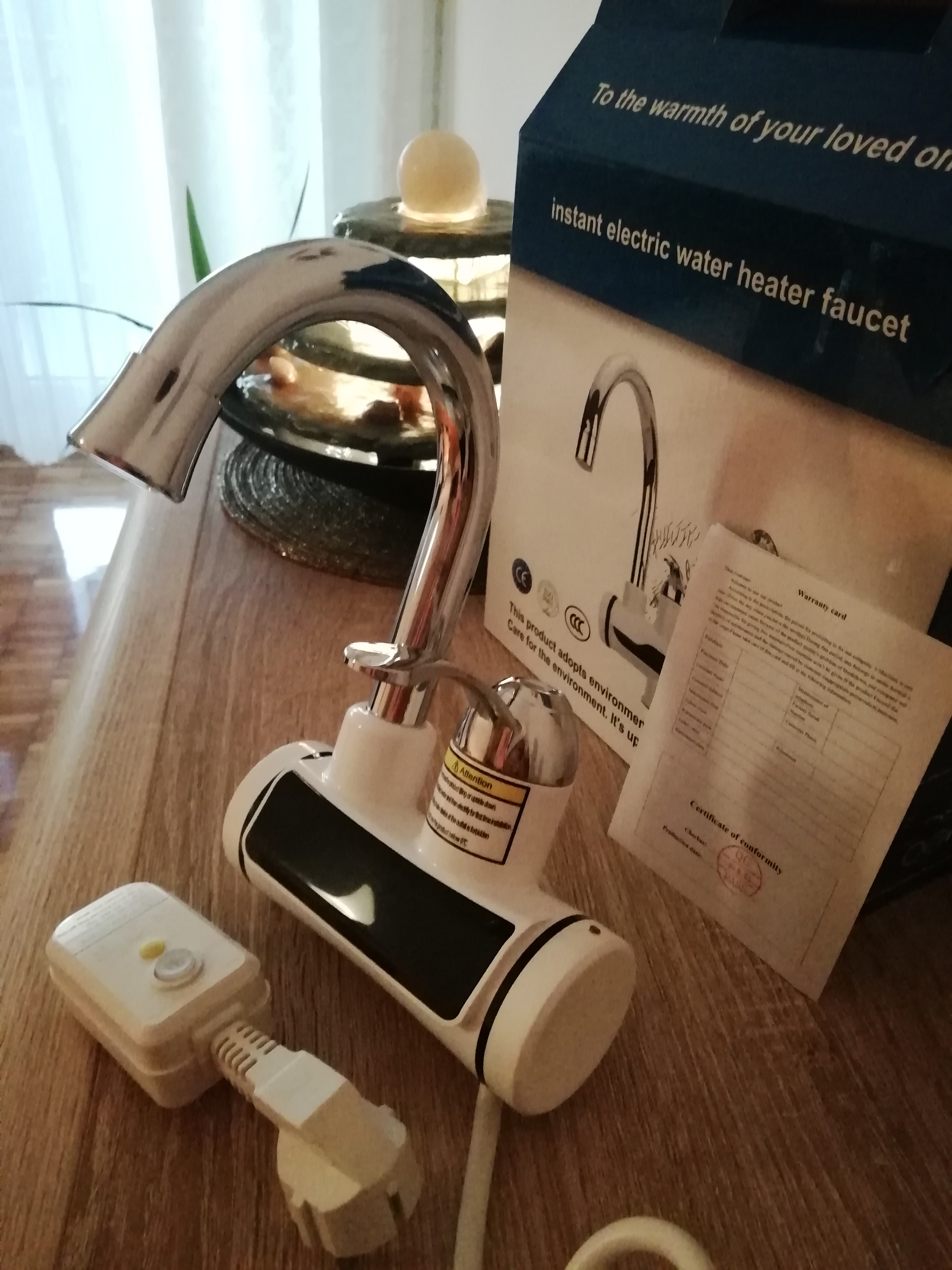

Electric Kitchen Water-Heater Faucet Tankless Instant Hot Water Faucets Led Instantaneous Heating Tap Sink Mixer 3300W 220V - AliExpress Home Improvement

Electric Kitchen Water Heater Tap 110V Flow Water Heater 220V Tankless Hot Water Faucet for Home Portable Instantaneous|Electric Water Heaters| - AliExpress

.jpg)