Popust 2pcs železa Polica Nosilec Za Visoko Teža Tovora Trikotnik Plavajoče Polica Podporo Stenske Black Nosilec Za Shranjevanje, Prikazovanje - Debelo \ www.velenje-svetamarija.si

Prodaja 8pcs Skriti Plavajoče Polica Nosilec Za Stenske Police Oklepajih Podpira Za Diy Po Meri Steno Plavajoče Odbor Police \ Dom za shranjevanje & organizacije - Monteco.si

Prodaja 2 kos 12 inch black plavajoče polica nosilec za slepe polica podpira oklepajih na plavajočih lesenih policah > Trgovina < Kosilonahitro.si

Na razprodaji! 1pc Stenske Police Nosilec za Police Nosilec za les Skrite Podporo Fiksno stojalo Tip Kovinski pladenj diy Pohištvo Strojne Opreme | Vrh < www.ventana.si

Črno železo Industrijske Polica Nosilec Nosilec Cevni Nosilec L Vintage Retro Steno Plavajoče Polica Za Omaro Za Shranjevanje Podstavki, Stojala Za Dom ~ Izboljšanje doma / Pr-kral.si

8pcs kovinske police nosilec z vijakom skrite plavajoče polica za vgradnjo v vozilo skriti stenske vesa težka podporo naročilo \ najboljši - Vitaminz.si

Trdna Jekla Plavajoče Polica Nosilec Nerjavnimi Slepi Polica Drywall Zid, Montaža za gozdno Lesnih Police < Nova ~ www.aleia.si

2Pcs/Veliko Matte Black Stenske Police Nosilec za Ustnice Oklepajih Podporo W Vijaki Obrtniški Kovani Težka Kmečka Plavajoče Polica naročilo \ center < Happytorta.si

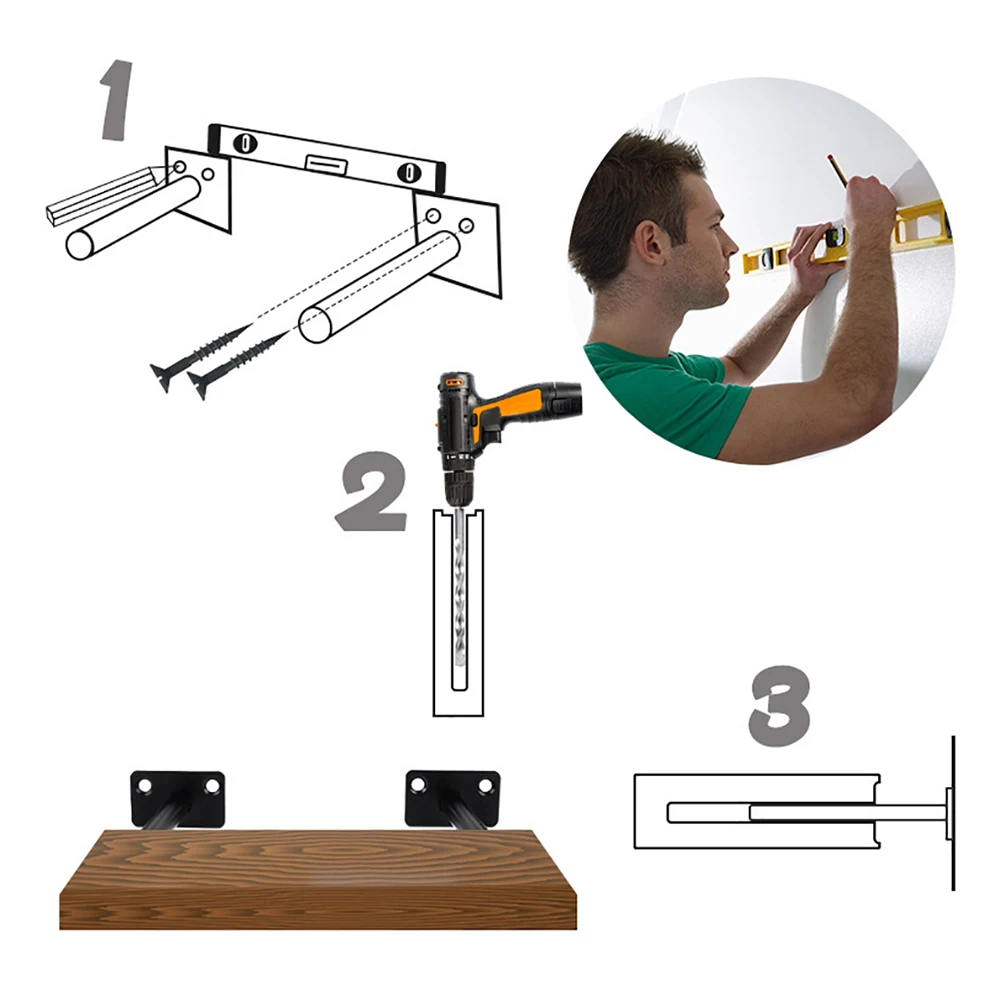

Plavajoče polica nosilec skriti polica podporo nevidno nametitev 10/12/14 mm beton drill bit sds plus \ Ročno & električno orodje, pribor | www.gostisce-majolka.si

Prodaja 4" 5" Težka Steno Plavajoče Polica Nosilec Prostor Ohranjevalnik Kota Nastavljiv Jekla Nevidno, Skrito Leseni Polici Podpira Strojna Oprema \ Izboljšanje Doma ~ Table.si

3inch 4 inch 5inch Zložljiva Polica Nosilec za Skrite Plavajoče Steni Polica Podporo Nosilci za Težka Lesa Polica nakup na spletu / Popust | Mbholding.si

1PC Plavajoči Polica Nosilec za Stensko Montirana Nevidno Nohtov Fiksni Nosilec Skrite Nosilec Skriti Imetnik Podporo Klopi Tabela nakup na spletu < Popusti / Zelenela.si

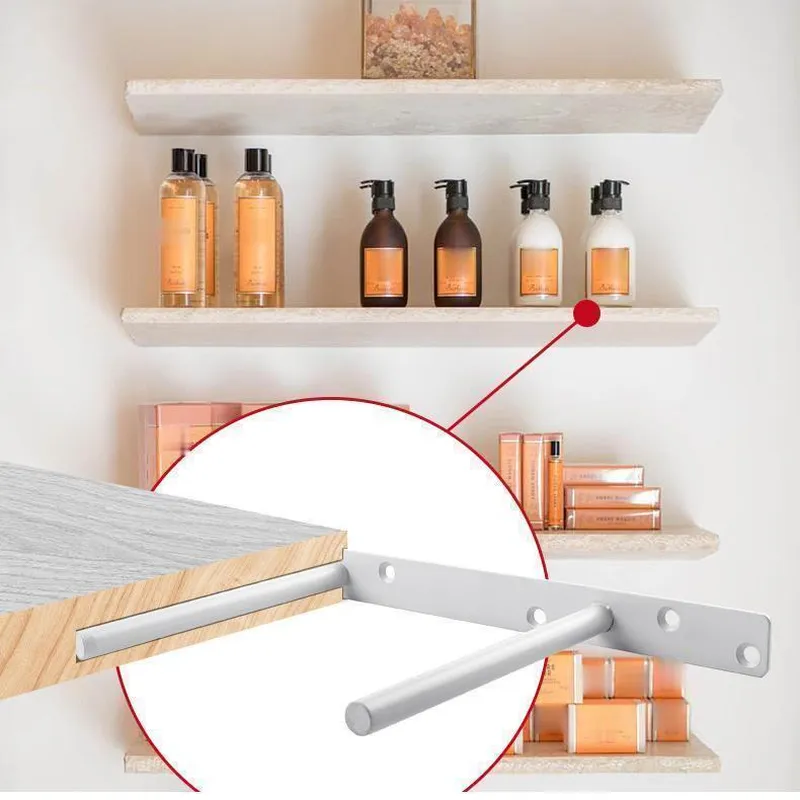

2pcs nevidno trdnega jekla plavajoče polica nosilec za skrite podporo plavajočih lesenih policah, mat črna bela dvojno dvojno bar \ Najboljši ~ www.sunumi.si

Prodaja 8pcs Skriti Plavajoče Polica Nosilec Za Stenske Police Oklepajih Podpira Za Diy Po Meri Steno Plavajoče Odbor Police \ Dom za shranjevanje & organizacije - Monteco.si

Prodaja 2 kos 12 inch black plavajoče polica nosilec za slepe polica podpira oklepajih na plavajočih lesenih policah > Trgovina < Kosilonahitro.si

4pcs črno železo Industrijske Cevi Polica Nosilec Nosilec Rack L Nosilec Vintage Retro Steno Plavajoče Polici Doma Dekor Nosilci Za Shranjevanje nakup - Prodaja > www.printdekor.si

2pc pohištvo polica oklepajih kovinski skriti plavajoče steni polica slepi stojalo kuhinja, kopalnica, kabinet podporo knjiga polica nosilec Na razprodaji! / center - Easybeer-koper.si

Na razprodaji! 1pair Stenske Police Nosilec Za Težka Odra Odbor Plavajoče Nosilec Industrijski Likalnik Podporo Tabela 25 Cm ~ Popusti / www.otok-hvar.si

Skrite Polica Nosilec Za Plavajoče Steni Polica Podporo Nosilci Za Težka Težka Podporo Nosilno Palico Kovinsko Pohištvo, Armature | Vtičnice ~ Smelt.si

Prodaja 8pcs Skriti Plavajoče Polica Nosilec Za Stenske Police Oklepajih Podpira Za Diy Po Meri Steno Plavajoče Odbor Police \ Dom za shranjevanje & organizacije - Monteco.si

6pcs stenske police nosilec za težka odra odbor plavajoče nosilec kmečko letnik železa podporo nosilec 20/25/30 cm naročilo \ najboljši - Vitaminz.si

Prodaja 1PC Plavajoče Polica Nosilec za Slepe Polica za Podporo Nove Trajne Elegantno Trdne Jeklene Skrite Oklepajih na Plavajočih Lesenih Policah / najboljši | www.ortezyprepsy.sk

Prodaja 2 kos 12 inch black plavajoče polica nosilec za slepe polica podpira oklepajih na plavajočih lesenih policah > Trgovina < Kosilonahitro.si

3inch 4 inch 5inch Zložljiva Polica Nosilec za Skrite Plavajoče Steni Polica Podporo Nosilci za Težka Lesa Polica nakup na spletu / Popust | Mbholding.si